Have you ever wondered how things got to be this bad? How has our economy got to the point where we are working two, three, or more jobs, yet we never “get anywhere?” Was it always this way where, basically, what comes in, goes right out? You work all damn week, get paid, and it barely covers the rent that’s due. Are you so very tired of living paycheck to paycheck?

Well, I’m here to tell you there is a different way, and I’m also here to tell you that no, it hasn’t always been this way. I’m old enough to remember when there were one parent income families. Yes, there were. One parent was employed, and not only that, I also remember there were much larger families back when I was a kid.

So, what happened?

Well, a lot, actually. We’ve had extremely incompetent leaders who really know nothing in terms of economic growth and who have policies in place that have whittled away our standard of living, little by little. It’s been so insidious that many haven’t really noticed, or they’ve been too busy working multiple jobs, and many born since never really learned any other way. But, I’m here to tell you that I have noticed, and no, this is not normal.

Well, a lot, actually. We’ve had extremely incompetent leaders who really know nothing in terms of economic growth and who have policies in place that have whittled away our standard of living, little by little. It’s been so insidious that many haven’t really noticed, or they’ve been too busy working multiple jobs, and many born since never really learned any other way. But, I’m here to tell you that I have noticed, and no, this is not normal.

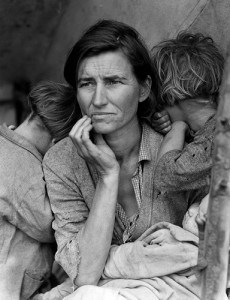

When my mom was a kid, yes, there was a “Depression,” and yes, they overcame the Great Depression long ago. But after our little growth spurt, and the Baby Boomer generation was born, times were good for a long while. Families were large, and yes, there were one income families – one parent was working and supporting the entire family.

When compared to today’s families, many more families back then used to go to the beach, camping, amusement parks, and more. It was normal. Dinner time and weekends were meant for family. Now, many families just can’t afford either the time or money spent on such things.

Now, some kids are lucky if they see both parents in the same room together and even then, one is coming in, while the other is going out to yet another job. And, of course, that’s even if you have two parents as so many have separated and/or divorced over “money issues.”

Well, as I have written in many of my articles, yes, there is another way, and it’s something “they” never taught any of us in school. …And, despite the brief moment of wondering why and going down “that” road, let’s instead look ahead at this new way of thinking to help end the “work once, get paid once” mentality.

Change Your Attitude

In fact, let’s call it your new “Life Investing” attitude. Make sure that everything you do reaps rewards and continues to reap rewards FOR you without any further effort.

In fact, let’s call it your new “Life Investing” attitude. Make sure that everything you do reaps rewards and continues to reap rewards FOR you without any further effort.

If you are tired of living paycheck to paycheck, then you must change your attitude. Turn it around. Instead of thinking of “working once and getting paid once,” think about your time or money spent and consider what will be returned. Apply this new attitude to whatever it is you do, whether it’s time or money spent. Think about how the results of this one time “investment” will continue to grow and add to your wealth. If you’re investing money, make sure that your money begins to work for you. If you invest time, make sure that whatever is gained, reaps rewards for years to come.

Yes, it really is that simple.

blue-chip graph.jpg

Knowledge Is Power

But, before you begin investing time or money, you’ll need to learn more about the best way to invest “for you.”

If it’s money, there are many types of investment vehicles, and yes, there are many financial “gurus” out there. There will be “experts” who are going to try to sell you this or that while advising you to stay clear of other products, etc. So, yes, it can be confusing, and you’ll have to do a little work to clear the fog that will be thrown your way.

One way to clear the fog is to learn as much about investing on your own as you can. Knowledge can only help you if you keep an open mind and learn from different sources.

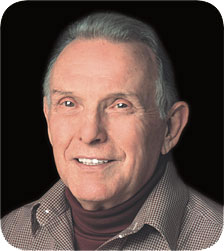

Take this guy, for example. This guy was a parking lot attendant. He has dyslexia, and, way back when, he pretty much accepted that he’d be a parking lot attendant for the rest of his life. But, he also kept an open mind, not to mention he had a great job location. Here’s his story:

“Let Your Money Work For You.”

Mr. Earl Crowley

In short, if you’re going to invest money, make sure interest and/or dividends pay you over time. After investing $25.00 per month in Mutual Funds for fifteen years, “Mr. Earl” began investing only in blue chip stocks – the stocks that pay out dividends. So, over time, not only did his stock portfolio value rise based on the stock prices and appreciation, but he reinvested his annual dividends to purchase additional stock raising his overall net worth. He “made his money work for him.”

The Infinite Banking Concept – Strategy

The Infinite Banking Concept (IBC) strategy, which I have also written about, outlines the same method used, but takes it one step further. The IBC strategy gets rid of the use of banks for personal loans entirely. This method builds your cash value whole life policy, and it allows you to use your cash value funds for major purchases instead of taking out a ‘traditional’ bank loan and paying THEM interest. When you pay back the “loan” from your cash value, you’re paying your cash value back – not interest to a bank. This is a much wiser use of assets, and the best part? You can even purchase and control policies for minor children. Policies can be purchased for as low as $10.00 a month for minors or even $25.00 a month for adults – depending on the amount of coverage purchased, the health of the one insured, and a number of other factors. You can read about that strategy by the founder himself, Nelson Nash. (See Below)

The Infinite Banking Concept (IBC) strategy, which I have also written about, outlines the same method used, but takes it one step further. The IBC strategy gets rid of the use of banks for personal loans entirely. This method builds your cash value whole life policy, and it allows you to use your cash value funds for major purchases instead of taking out a ‘traditional’ bank loan and paying THEM interest. When you pay back the “loan” from your cash value, you’re paying your cash value back – not interest to a bank. This is a much wiser use of assets, and the best part? You can even purchase and control policies for minor children. Policies can be purchased for as low as $10.00 a month for minors or even $25.00 a month for adults – depending on the amount of coverage purchased, the health of the one insured, and a number of other factors. You can read about that strategy by the founder himself, Nelson Nash. (See Below)

Your Time is Also Valuable

Your new attitude change should also encompass time spent. Whether you realize it or not, your time is valuable, and if you also apply the same mentality to time spent, then you need to make sure that any time spent on something will reap rewards.

In the past, we were all taught that if “we work hard, we’ll be rewarded” with a better job, better pay, a promotion… etc. But, as we all now know, there is that risk that things just don’t work out. Things can and do go sideways, and many do not reach the goals they may have had. So, what’s the alternative?

You Need A New Employer

Employ your newly adopted attitude! If you spend time on something, you need to be realistic and minimize your risk that things may not pan out as you had expected. Think about what you can do to minimize, or better yet, eliminate your risk.

Employ your newly adopted attitude! If you spend time on something, you need to be realistic and minimize your risk that things may not pan out as you had expected. Think about what you can do to minimize, or better yet, eliminate your risk.

Spend time on something of your own that will work out – no matter what may happen elsewhere. Whatever you do, make sure it continues to reap rewards. This could apply to owning residential or commercial real estate, tax lien certificates, blue chip stocks, whole life policies (using the IBC method), and internet or affiliate marketing. This applies to anything that pays you interest, dividends, and any type of additional and guaranteed passive income over time resulting from your “one time effort.”

Wash, Rinse, Repeat…

Then, do what the wealthy have known about for quite some time. Do it again. In fact, do it over and over again. Build multiple streams of passive income, and “Make Your Money Work For You!”

Stop the madness and your thinking that by working once, and getting paid once will ever get you ahead, never mind out of the hole. It will never happen – especially if we keep electing incompetent leaders and policy makers who are only looking out for their own self interests. You must make your money work for you – while you’re adding to it over time. Just make sure you protect your nest egg as well. Be aware of policy makers and that the Government, “could” raid 401K accounts, but they can’t touch whole life insurance policies simply because of contract law. Be more aware, read, and build your knowledge.

“When I send out my soldiers, they better come back with prisoners, so there’s more.”

Mr. Wonderful, Kevin O’Leary

Start Reading…

In addition to the Nelson Nash books, mentioned above, here are a few more good reads. If you haven’t read any yet, I highly – highly recommend them.

It’s time to change your attitude. It’s time to take your future into your own hands and think about the return you’ll receive whenever you think about spending time or money. It’s time to build your wealth. Time to stop being tired of living paycheck to paycheck. Do SOMETHING DIFFERENT! You can! You Must!

It’s time to change your attitude. It’s time to take your future into your own hands and think about the return you’ll receive whenever you think about spending time or money. It’s time to build your wealth. Time to stop being tired of living paycheck to paycheck. Do SOMETHING DIFFERENT! You can! You Must!

To Your Wealth!

![]()