Want to just get started? Click here to sign up for ZenBusiness and start your LLC in Pennsylvania today.

Most small business owners prefer to form an LLC primarily for personal liability protection.

An LLC allows you to take calculated risks to grow your business without worrying about losing personal assets in case of a lawsuit or bankruptcy.

LLCs also offer additional advantages, including tax options, flexible management structure, and business credibility.

The Top Business Filing Services for Starting an LLC in Pennsylvania

The best part is you don’t have to worry about the paperwork or filing process if you choose an LLC formation service. We’ve even handpicked the best ones for your convenience, including:

- ZenBusiness – Best overall

- Incfile – Best for entrepreneurs on a tight budget

- Rocket Lawyer – Best legal consultation services for LLCs

- LegalZoom – Most popular LLC Services

- LegalNature – Best for LLC documents and contracts

- MyCompanyWorks – Best same-day processing

- Swyft Filings – Best customer service

You can read our full reviews of each LLC service here.

6 Steps to Start an LLC in Pennsylvania

Forming an LLC is an exciting time for any small business owner. The promise of personal liability protection is enough enticement to start right away. So we’ve put together this guide to clear up any misconceptions and confusion surrounding forming an LLC.

Below is what you need to do to form an LLC in Pennsylvania.

- Choose a Pennsylvania LLC Formation Service

- Choose the Type of LLC

- Choose a Name for Your Pennsylvania LLC

- Designate a Registered Office

- File a Certificate of Organization

- Wait for Confirmation

The Easy Parts of Starting an LLC in Pennsylvania

The good news is that forming an LLC in Pennsylvania is relatively clear-cut. It doesn’t matter if you choose to do it with an LLC service or on your own. In addition, the Pennsylvania Department of State has detailed the formation process, so there’s little chance of losing your way.

You might not even need a lawyer to help form your LLC. Although recommended, you can conceivably go through the formation process with few hurdles.

Furthermore, an LLC is easier to form than a corporation. You don’t have to worry about shareholder meetings, creating a board of directors, or recording meetings. You can continue to operate your business as usual with few oversight requirements compared to corporations.

Finally, an LLC is inexpensive to create. The filing fee is certainly a worthwhile expense. You are especially considering the potential benefits of your new business structure.

The Difficult Parts of Starting an LLC

The LLC formation process is straightforward but not exactly simple. First, the requirements are spelled out. But, missing a single document or license means you must start the process from the beginning.

Like most bureaucratic processes, forming an LLC takes time. This scenario is especially true if you go through the process yourself.

Lawyers and LLC services have contacts in the state department that can help expedite the process. However, individuals don’t have the same privileged. Forming your LLC during a time crunch can be a frustrating process.

Naming your LLC might also be a challenge. You can’t create an LLC under the same name as an already registered company. So, you might need to change your company name if you’re unlucky.

Similarly, choosing a name for your LLC might be challenging. Again, there are complex copyright and trademark issues to avoid. There’s also the possibility of penalties for trademark infringement if you’re not careful.

Specific terms you’ll need to avoid when choosing your LLC name. For example, you can’t use words that might mistake your LLC for a corporation. These include terms such as ‘incorporated,’ ‘Inc.,’ or ‘Corp.’

In short, forming an LLC can be frustrating and confusing if you don’t have a legal background. You’ll need to be careful to dot the i’s and cross the t’s the first time or repeat the filing process. It’s a risk since you might have to forfeit the filing fee if your application doesn’t go through.

With the easy and challenging parts out of the way, let’s get to what it takes to form an LLC in Pennsylvania:

Step 1: Choose a Pennsylvania LLC Formation Service

As you will soon discover, forming an LLC is a complex web of paperwork, licenses, and permits. An LLC service can help you wade through the paperwork and guarantee that your application goes through the first time. If nothing else, these services also offer free tools to help you with the formation process.

Choose ZenBusiness

We think that ZenBusiness is the best LLC service for most. The platform offers flexible plans, so it’s a good idea to visit the ZenBusiness website immediately.

The best part is you don’t have to commit to using its LLC filing service. Instead, you can choose specific products, such as designating ZenBusiness as your registered agent service or purchase an operating agreement template.

But, of course, you’ll need to meet these requirements, so exploring what the formation service offers makes sense.

Alternatively, you can go for an all-inclusive package. It comes with everything you need to form an LLC. This includes the state filing fee, operating agreement template, registered agent service, and EIN. Plus, ZenBusiness will file the application on your behalf.

Fill Out the ZenBusiness Questionnaire

Again, ZenBusiness is flexible, so you only pay for the services you need. The service provides a questionnaire to understand the services you need. Then, you’ll get a quote based on what you choose.

You’ll be requested to fill in information such as the type of entity you wish to form, the company name, and other details about your business. The questionnaire is simple, and you don’t have to worry about talking to an agent until you’re ready.

Step 2: Choose the Type of LLC

Pennsylvania offers three different types of LLCs. Getting familiar with these options will help you file the correct paperwork. You’ll also form the best kind of LLC for your business and industry.

Standard LLC

Most people think about the standard LLC when forming their company. It’s the most popular type of LLC and fits most small businesses. It’s also the type of LLC most people think about when filing.

Benefit LLC

This type of LLC applies to non-profits and for-profit businesses with a positive social impact. Companies that qualify for Benefit LLC include those that:

- Serve low-income individuals and households

- Facilitate job creation or offer economic opportunities

- Protect the environment, including preserving and rebuilding the environment

- Help to advance technological developments

You may benefit from a significantly lower filing fee if your business qualifies as a Benefit LLC. It’s also a positive designation that might make your business more competitive in the industry you serve.

Restricted LLC

Certain businesses must file for a Restricted LLC. In this case, you cannot file as a standard LLC. Businesses in this category include:

- Dentistry

- Chiropractic

- Optometry

- Law

- Public accounting

- Medicine and surgery

- Veterinary medicine

- Psychology

- Podiatric medicine

Again, your LLC service can help you determine the appropriate type of LLC for your specific business. Alternatively, you can visit the Pennsylvania Department of State website for more information about the kinds of LLCs, associated forms, and filing fees.

Step 3: Choose a Name for Your Pennsylvania LLC

You’ll need a unique company name to operate an LLC in Pennsylvania. You can’t register an LLC using a registered name with the Department of State.

Perform a Name Search

First, you’ll need to ensure that your desired business name is available. You can search it on the Bureau of Corporations and Charitable Organizations website. The state department maintains a database of all registered businesses.

Alternatively, you can search your business name using your LLC service. For example, ZenBusiness offers business entity search as a stand-alone service. Alternatively, the service will search your business name as part of its LLC filing service.

The LLC name search is also a standard service regardless of your chosen filing company.

Check if the Domain Name is Available

It’s hard to think of a modern business operating without a website. It’s the best way for customers to learn about your products or services. Ideally, your domain name should be similar to your business name.

Now is an excellent time to determine if the domain name is available. It will save you problems down the line when you want to create a business website. Domain registry services such as GoDaddy let you search and register your domain.

Reserve Your Business Name

It might take some time before your LLC is registered officially. So you want to avoid someone else taking the name. This is especially important if you don’t plan on registering your LLC immediately.

Fortunately, you can reserve your business name with the Pennsylvania Bureau of Corporations and Charitable Organizations. You can reserve your business name for up to 120 days.

ZenBusiness also offers a business name reservation service for a one-time fee of $50. Again, this can be a stand-alone service. Or, you could choose it as part of your LLC registration package.

Step 4: Designate a Registered Office

Pennsylvania requires LLCs to appoint a registered office. A registered office is an official mailing address where you’ll receive all legal mail.

Choose Your Registered Office

Please note that a registered office must be a physical address. A P.O. Box doesn’t qualify as a registered office. The physical address can be for a Pennsylvania registered business or resident.

Alternatively, you can assign a Commercial Registered Office Provider (CROP) as your registered office. You’ll need to pay a fee for this service. Then, the CROP will offer you a registered office address.

ZenBusiness also offers Registered Agent services. The service costs $199 bulled annually.

Becoming Your Registered Agent

You can technically appoint yourself as the LLC registered agent. Of course, you’ll need to be a Pennsylvania resident. Similarly, you’ll need to provide a physical mailing address.

The registered agent is responsible for receiving legal notices and government mail. So, you’ll need to be available during regular business hours. This requirement can be an issue if you’re out of town on a business meeting or vacation.

It’s almost always a bad idea to serve as your registered agent. Operating a business is difficult enough without having to deal with legal notices, service of process documents, and other technical mail.

Additionally, you’ll be responsible for receiving notifications of lawsuits and subpoenas. It’s a stressful job, and you could be served in front of your valued clients or business associates.

For this reason, we strongly recommend designating a third party to serve as your registered agent.

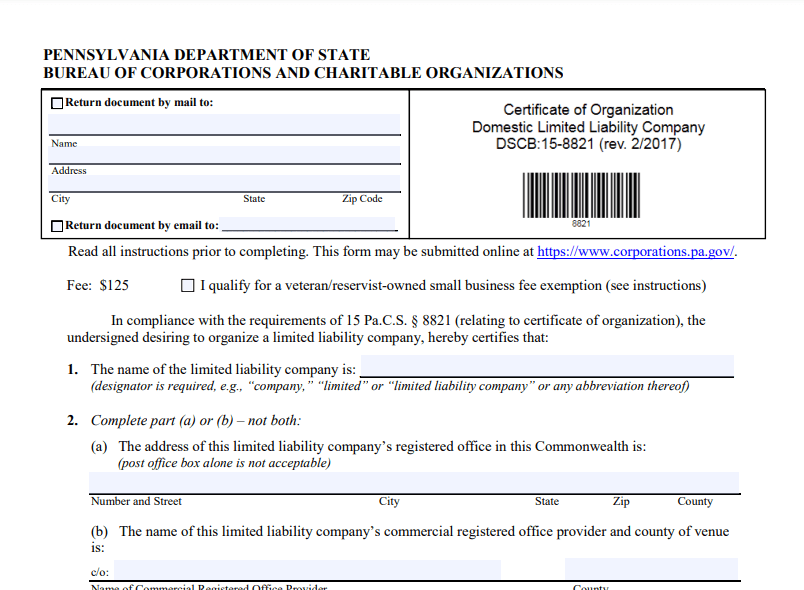

Step 5: File a Certificate of Organization

Like most states, Pennsylvania requires you to file a Certificate of Organization to register your LLC. Some states call it an Articles of Organization. This document is the primary paperwork you must complete to register your LLC successfully.

File the Certificate of Organization

First, download Form DSCB: 15-8821 from the PA Department of State website. This form is the Certificate of Organization. Then, fill the form with the required information.

Some of the details you’ll need to enter include:

- Your limited liability company name

- Business mailing address

- Names of all members and organizers

- The organization’s effective date

- Type of LLC designation

The Certificate of Organization attracts a $125 filing fee. But, again, you can file the document via your LLC filing service.

Obtain an Employer Identification Number (EIN)

You’ll need to file an Employer Identification Number (EIN) for an LLC with more than one member or employee. You’ll need this number for multiple requirements. For example, you need an EIN to hire employees, open a business bank account, file taxes, and file your New Entity Docking Statement.

You can apply for your EIN with the IRS. It’s free, and you can do it online on the IRS website.

Alternatively, you can obtain your EIN through your LLC filing service. ZenBusiness charges a one-time fee of $99 for this service.

File You Docketing Statement

You’ll also need to file a Docketing Statement with the Certificate of Organization. In addition, you’ll be required to provide details such as the LLC name, a description of its business activity, and EIN.

ZenBusiness charges $49 for the Expedited service. It takes about 6-8 business days to register your LLC. However, ZenBusiness also has a Rush package that costs $99. It takes about 3-4 business. You’ll still need to pay the $125 state filing fee.

Step 6: Wait for Confirmation

You’ll receive a confirmation on whether your LLC has been registered successfully. The confirmation is a copy of the filed certificate in the mail. You’ll also receive a notification if your application is rejected.

The Department of State will explain why it rejected your request. You’ll also get an opportunity to re-submit your application.

Apply for the Necessary Licenses

The filed certificate is your go-ahead to apply for the relevant business licenses. These might include:

- Local city or county licenses

- Zoning permits

- Professional licenses

- Sales tax permits

- Health and safety licenses

- Liquor licensing and other regulatory permits

The specific licenses you need depend on your type of business. You can consult the Department of State for information about the licenses you need for your business.

Create an Operating Agreement

An operating agreement isn’t mandatory for LLCs. However, it’s a good idea to create one. The operating agreement documents crucial details about your LLC, including:

- General organization information

- Management and voting

- Capital contributions

- Distributions

- Dissolution

- Changes to the membership structure

An operating agreement is critical for ensuring that all members are on the same page. It’s also a legally-binding document that the courts may use to resolve or mediate conflict between members.

Open a Business Account

You want to keep your business and personal finances separate. Therefore, it’s good to open a dedicated business account. In addition, this separation will make filing taxes easier.

You’ll also need to separate your personal and business assets to enjoy personal liability protection. Similarly, consider getting a business credit card.

The credit card is useful for building a business credit score. The card is also helpful for tracking your business expenses for tax reporting.