The Prairie State is an excellent place to start an LLC.

Illinois has major cities like Chicago, industrial areas, natural resources, land for agricultural productivity, and seemingly endless opportunities.

The LLC entity structure is a popular choice for new businesses in Illinois.

But if you’re a first-time entrepreneur and you’ve never formed a new business, the LLC formation process in Illinois can be a bit intimidating.

Fortunately, we’ve simplified the entire process into just five easy steps.

The Easy Parts of Starting an LLC in Illinois

Forming an LLC in Illinois helps separate your personal assets from the business. This limits your liabilities and debts if the company gets sued or owes money to lenders.

Compared to a sole proprietorship, LLCs have some potential tax advantages as well. You can take the default pass-through taxation for LLCs or choose to be taxed as an S corp.

If you’re deciding between an LLC and a corporation in Illinois, your Illinois LLC will have fewer compliance requirements than a C corp. Unlike a corporation, LLC earnings aren’t subject to double taxation. It’s also worth noting that LLCs in Illinois pay a lower personal property replacement tax compared to their corporate counterparts.

Lots of entrepreneurs get hung up on the LLC formation process. They’re intimidated by the paperwork, filing, and requirements. While it may seem like a lot to comprehend, it’s actually fairly simple—especially if you’re using an LLC formation service in Illinois.

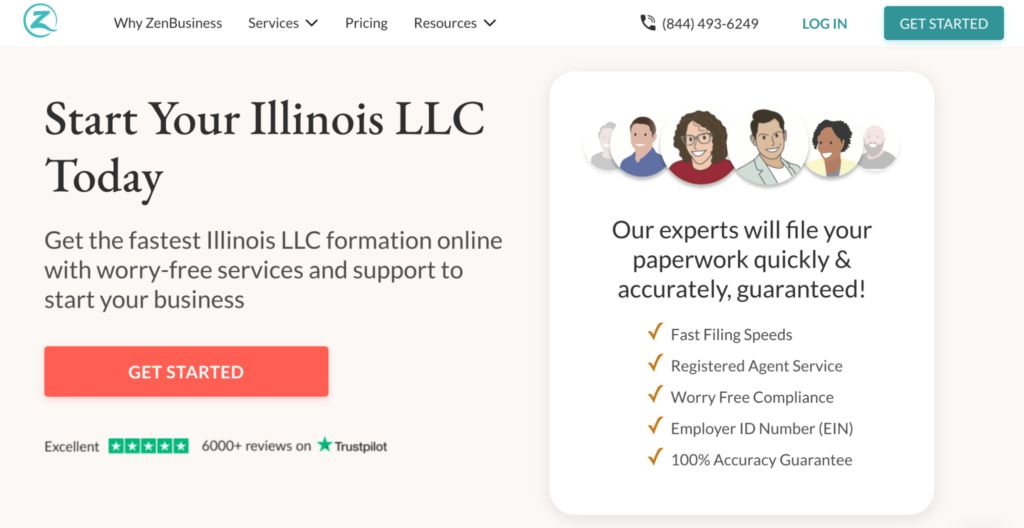

Online business formation services like ZenBusiness make it easy for anyone to start an LLC in Illinois.

Here’s how it works. Start by answering a few questions about yourself and the business. From there, ZenBusiness will take your information and fill out the appropriate LLC formation paperwork on your behalf.

Then they’ll file those forms directly with the Illinois secretary of state office.

ZenBusiness also offers registered agent services, operating agreement templates, EINs, annual report service, and worry-free compliance—all backed by a 100% accuracy guarantee.

With plans starting at just $49 plus Illinois state filing fees, it’s an exceptional value for LLC formation.

The Difficult Parts of Starting an LLC in Illinois

Starting an LLC in Illinois does come with a handful of challenges.

Compared to LLCs in other states, the initial $150 filing fee is on the higher end of the spectrum. There’s also a $75 annual renewal fee to consider. But these are fairly marginal in the grand scheme of things, so don’t let these small costs discourage you.

Similar to a sole proprietorship, LLCs in Illinois are subject to self-employment taxes by default. You’d need to change your tax status to S-election to modify this structure.

In addition to the tax requirements, you’ll also need to follow all guidelines for LLCs in Illinois to remain in good standing with the state. I’m referring to things like annual report filing, employee reporting, workers compensation insurance, business licenses, renewals, and more. It’s easy to lose track of these requirements when you’re running a business.

While forming an LLC in Illinois is easy, you still have plenty of hard work ahead of you.

This will obviously vary based on business type and industry. But most LLCs need to find office space, buy equipment, hire employees, and start attracting customers. This is much easier said than done.

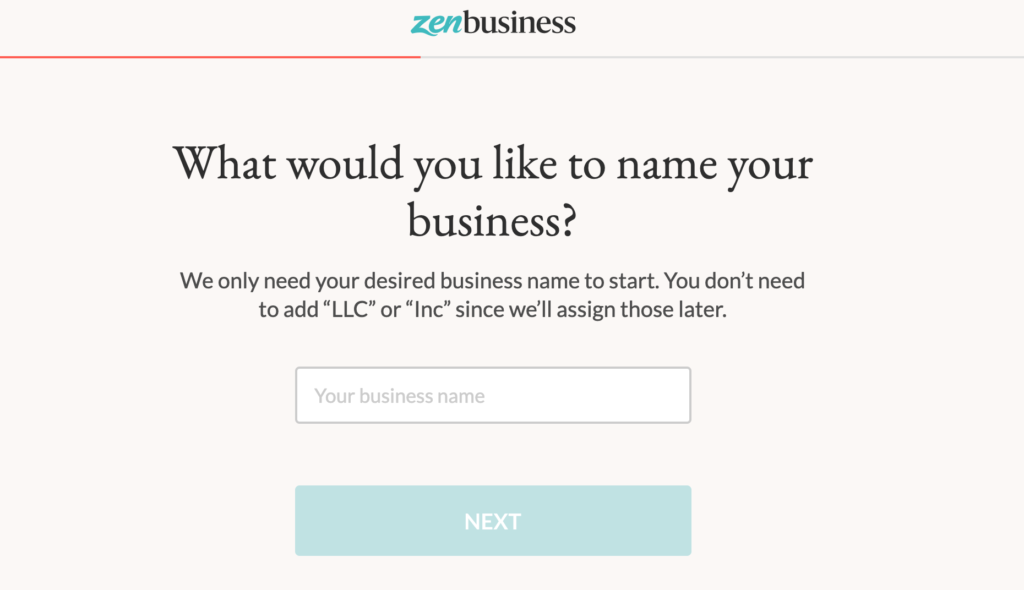

Step 1 – Name Your Illinois LLC

Starting an LLC in Illinois all begins with finding the right name.

You can’t just pull this name out of thin air. In addition to the name requirements for an LLC in Illinois, you’ll also want to ensure that the name is brandable and works well for your business type.

Follow Illinois State Guidelines For LLC Names

Each state has its own unique rules and regulations for LLCs. Illinois law has specific guidelines that all LLCs must follow when choosing a name.

The complete guidelines can be found on Publication C334 – Guide for Organizing Domestic Limited Liability Companies in Illinois. But here’s a summary of the highlights:

- Names must contain the words Limited Liability Company (can be abbreviated as LLC or L.L.C.).

- Names cannot contain the words Corporation, Corp, Incorporated, Inc., Ltd., Co., Limited Partnership, or LP.

- Names must be distinguishable from others in the secretary of state database.

- Words that imply insurance, assurance, or banking are prohibited unless permitted by the Secretary of Financial and Professional Regulation.

- LLCs must contain the word “trust” if the purpose is used to accept and execute trusts.

Make sure you give the publication an in-depth review before you land on a name for your Illinois LLC.

Run a Business Name Search

Next, you need to make sure another business in Illinois isn’t using the name you want to register. There are a couple of different ways to approach this step.

You can run a name search using the Corporation/LLC/Certificate of Good Standing database on the Illinois secretary of state website.

Although this can be a bit of a challenge since Illinois requires your name to be clearly distinguishable from another business name. So if your name is only off by a letter or two, you might not find a hit on this resource.

If you’re using an LLC formation service like ZenBusiness, they’ll automatically check the name’s availability against the Illinois state database.

ZenBusiness also offers a business name reservation service for just $50. This is ideal for those of you who have a name you like, but you’re not quite ready to proceed with the rest of the LLC formation process just yet.

You can also reserve an LLC name in Illinois on your own using Form BCA 4.10. Business names can be reserved for up to 90 days in Illinois.

Check the Name’s Availability For Other Purposes

Assuming your business name meets Illinois state guidelines and it’s available to register in the state database, there are a few other places you should check before making things official.

Most new businesses in Illinois will also need a website. So you should check to see if your desired domain name is available, assuming you want the domain to match your LLC name.

If the name is already registered and not available to buy for a reasonable price, you should probably brainstorm another name. Names are a dime a dozen, so don’t invest a ton of money into buying a domain if you can avoid it.

I also recommend checking the USPTO database for federal trademarks. If another business has trademarked the name, you’ll want to make sure that you’re not in breach of their trademark. This is also an important step for the long-term scalability of your business if you eventually plan to register a trademark on the name.

Don’t forget to check and see if the social media handles and profiles associated with your LLC name are available. This can pose a problem for marketing and branding purposes if someone else is using that name.

Running a quick Google search on your proposed LLC name is always a good idea too. Avoid names that have a poor history and unfavorable media attention, even if those stories have nothing to do with your business.

Step 2 – Appoint an Illinois Registered Agent

According to Illinois state law, every domestic and foreign LLC must maintain a registered agent at all times. The agent may be a natural person who resides in the state. It can also be a legal entity that’s licensed to transact business in the state of Illinois.

The registered agent’s office must be a physical street address—a PO box alone is not acceptable.

That’s because an Illinois registered agent must be able to accept service of process and official government correspondence on behalf of your LLC. The agent must be available in person during normal business hours for this type of correspondence.

Being Your Own Registered Agent in Illinois

Technically, you can be your own registered agent in Illinois as long as you’re a state resident. But I typically advise against this.

First of all, this would require you to be available in person during all normal business hours. While nobody will be checking in on this day-to-day, you could land yourself into some compliance trouble if government correspondence can’t be hand-delivered.

It’s also really embarrassing for business owners if they’re served with a lawsuit in front of employees and customers.

For those of you running a business from your home, that address will become part of the Illinois state public records if you act as your own registered agent. Most people prefer to avoid this.

Using a Registered Agent Service in Illinois

It’s much easier to appoint a third party as your registered agent in Illinois. If you’re using ZenBusiness to form your Illinois LLC, it makes sense to use them as your registered agent as well.

The registered agent service starts at $99 per year. This includes standard registered agent duties, online document access, and expert support. ZenBusiness also offers worry-free compliance with its registered agent service if you opt for the Complete Coverage package—starting at $149 per year.

Step 3 – Draft and File Your LLC Formation Paperwork

Now it’s time to officially form your LLC in Illinois. This step will make everything official.

You can file all of the paperwork on your own directly with the secretary of state office. But using an LLC formation service will make your life much easier. ZenBusiness will ensure the accuracy of the paperwork and file everything directly with the Illinois secretary of state on your behalf.

Articles of Organization

To register an Illinois LLC, you need to complete and file Form LLC-5.5 – Articles of Organization. There’s a $150 filing fee associated with this application, which you’ll need to pay whether you’re filing on your own or using a formation service.

The articles of organization in Illinois must include:

- Name of the LLC

- Principal place of business

- Effective date (must be within 60 days of filing)

- Name and address of your Illinois registered agent

- Purpose of the business

- Dissolution date (if applicable)

- Name and address of LLC manager or managers (if it’s a manager-managed LLC)

- Name and address of the officer filling out the form

It typically takes between seven and ten business days to process the paperwork in Illinois. If you’re using ZenBusiness, they can help expedite the filing for an additional fee. This service is included in the higher-tier formation packages.

Operating Agreement

Illinois does not require LLCs to file a copy of the operating agreement with the state. But it’s highly recommended that you create one of these documents, especially if you’re working with multiple members and managers.

Your operating agreement is a legally binding document that outlines the management structure and governing rules for your LLC.

An operating agreement template comes standard with all ZenBusiness LLC formation packages.

Step 4 – Open New Business Accounts

Next, you need to put yourself in a position to operate as a business entity in Illinois. There are a couple of different accounts you need to open right away to make this possible.

Get an EIN

Technically, an EIN isn’t an account. But you’ll need this number to open other accounts, and it’s required for federal tax purposes and state taxes in Illinois.

EIN stands for employer identification number. It’s also known as a TIN (tax identification number) or just Tax ID. You’ll have the option to get an EIN from ZenBusiness when you’re going through the formation process.

This is free with the Pro and Premium formation plans. Alternatively, you can get an EIN directly from the IRS.

Business Banking

Once you have an EIN, you should open a business checking account. You likely won’t be able to open an account without your EIN.

If you plan to accept credit cards, you’ll also need to research a merchant account provider.

This provider can assist you with credit card terminals, virtual terminals, online payment processing, and everything else you need to accept credit cards and debit cards. In some cases, you can get your business banking and merchant account services under one roof from a single provider.

Step 5 – Prepare For Illinois Taxes, Compliance, and Employer Obligations

Now that you’ve officially started an LLC in Illinois, you need to prepare for the future. Make sure you remain in good standing with the state by complying with all tax laws, licensing rules, and employer obligations.

The exact requirements vary by business type and industry. Here are some examples of steps you might need to take.

- Register with the Illinois Department of Revenue

- Check to see if you need any Illinois business licenses

- Purchase workers compensation insurance as soon as you hire your first employee

- Report new hires to the Illinois Department of Employment Security within 20 days of hiring

- Calculate and pay unemployment taxes

- File an annual report

ZenBusiness’s top-tier registered agent service comes with worry-free compliance. They’ll help you with annual filings and state compliance to ensure you remain in good standing with the Illinois secretary of state.