Many business owners may require an external source of financing at some point. Whether you’re launching a new business, bridging a cash flow deficit, or expanding a business, it’s essential to consider your financing options carefully. The two most popular options are taking a business loan or applying for a business line of credit.

A business loan is the best option for most people. It allows cash-strapped small businesses to finance a significant investment, a major acquisition, or expansion, usually with fewer limitations and lower interest rates. However, the comparison isn’t always this cut-and-dried.

Read on to find out which financing option suits your specific business needs.

Business Loan Pros and Cons

Pros

- Extended repayment periods

- Lower interest rates

- Receive a lump sum upfront

- Predictable payment plan

Cons

- Slow to fund

- Rigid repayment terms

- Stricter credit score requirements

Business Line Of Credit Pros and Cons

Pros

- Flexible repayment structure

- Generally easier to qualify

- Quick funding times

- Ongoing access to capital

Cons

- Lower borrowing amounts

- Shorter term length

- Higher interest rates

The 11 Best Business Loans for 2022

No matter your company size or capital needs, we’ve identified the top 11 best business loans available. Read our in-depth reviews on each to see which might be the best fit for your company and future plans.

- Bluevine — Best for established businesses seeking lines of credit up to $250,000.

- Lendio — Best small business loan marketplace with 75+ lenders.

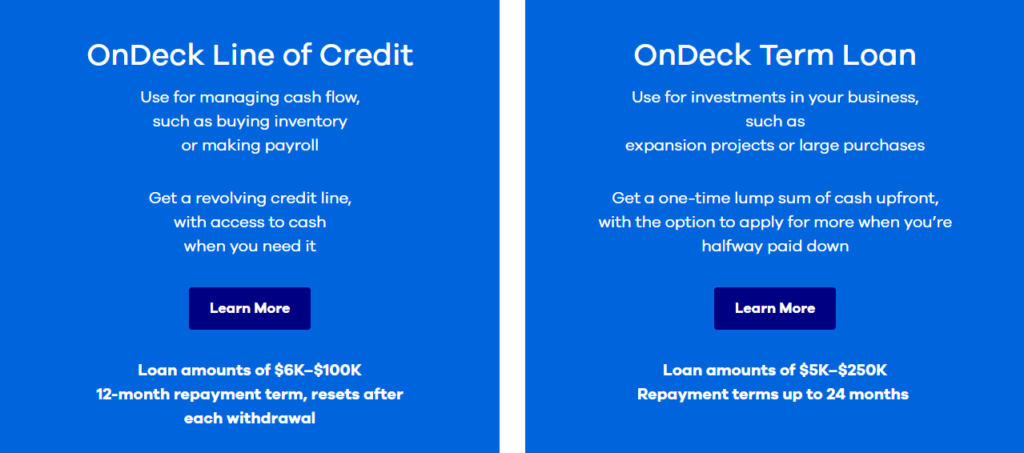

- OnDeck — Term loans and lines of credit for business owners with a 600+ FICO score.

- Fundbox — Best for new businesses in need of inventory or supplies from vendors.

- Funding Circle — Best small business lender for loan terms up to five years.

- Kabbage — Best for businesses with low monthly or annual revenue.

- Lending Club — Best P2P lending marketplace for business loans.

- Kiva — Microloans up to $10,000 at 0% interest for entrepreneurs.

- SmartBiz — Best for SBA loans up to $5 million with 25 year terms.

- Credibility Capital — Bank-backed loans for business owners with great credit.

- CAN Capital — Best merchant cash advance for small business.

Loan Type: Business Loan Wins

A business loan is a type of fixed-term financing typically offered by banking institutions. The bank or financial institution gives you a lump sum that you repay with interest. You’ll make regular payments until you repay the principal plus interest.

You can use a business loan for multiple things, including purchasing business assets, expansion, or paying off business debts. You will likely need to specify the purpose of the funds in your loan application–and may need to show proof you are using the funds for that purpose.

For example, you can request a loan to purchase equipment. Often you will then be unable to use the funds for any other purposes, such as repaying debts or paying employees during a lean month.

There are multiple types of business loans, including:

Traditional Term Loans – This is the most common type of business loan. The lender offers you a lump sum which you pay off regularly on a fixed repayment schedule. Most of these loans require collateral.

Small Business Administration Loans – The Small Business Administration (SBA) guarantees loans for small businesses. For example, the SBA may offer to repay 85% of your loan up to a certain amount.

Unsecured Business Loans – These loans work just like traditional term loans, except you are not required to put up collateral to obtain funding. These loans tend to have higher interest rates and stricter credit score requirements.

A line of credit is more like a credit card than a business loan. First, the lender designates a sum of money up to a certain amount. Then, you can access the funds as needed and repay them over time.

Additionally, you’ll only pay interest on the borrowed amount. You can replenish your line of credit as you repay part or all of the borrowed funds. Then, you’ll be able to access the full line of credit once more.

There are different types of LOCs. The first is a secured line, also called an asset-based line. You must provide collateral to qualify for the line of credit. Examples include real estate, personal assets, and business cash.

The second type of LOC is the unsecured line of credit. You don’t need to provide collateral. However, this option might be more expensive than a secured LOC. Lenders typically offer high-interest rates and fees to cover their risk.

Generally, a business loan offers more flexibility. For example, you can apply for an equipment loan and use the equipment as collateral. There’s also the possibility of the SBA guaranteeing part of the loan if you qualify for its programs.

Finally, though a business loan may be harder to qualify for, you’ll benefit from lower interest rates. This case is especially true compared to an unsecured line of credit.

Lender Type: Business Loan Wins

You can borrow a business loan from many different types of lenders, including traditional banks, the Small Business Administration (SBA), and online lenders.

Similarly, you open a line of credit with a bank, direct lender, or the SBA. However, more lenders offer business loans than lines of credit. You shouldn’t have difficulty finding a line of credit if you meet the requirements.

Still, business loans offer more diverse options and lenders. This diversity makes it easier to price shop. You’re also more likely to find a good deal. For example, some lenders are willing to beat the competition’s interest rates or loan terms.

Funding Needed: Business Loan Wins

Business loans typically offer larger borrowing amounts. You can borrow anywhere from $500 to $5,000,000. Additionally, you can get a short-term loan for smaller amounts and pay it off in six to 24 months. It’s a good option for short-term expenses like paying seasonal employees or purchasing inventory, or to cover an emergency or lean time when you know more income is a few months away.

Similarly, you can apply for a long-term loan with a three or five-year term to purchase equipment or construct a new warehouse. Some business loans have an extended period of up to 10-30 years.

A business line of credit typically offers lower amounts. For example, most lenders offer a maximum of $250,000. A LOC is designed to have a shorter term, hence the lower credit amount.

Interest Rates and Loan Terms: Business Loan Wins

Business loans typically have lower interest rates. This is especially true for secured loans.

Business loan terms are also clearly structured. For example, you know exactly how much interest you need to pay and when your payments are due. These payments are also scheduled so you can easily forecast your cash flow.

A line of credit is less rigid. For example, repayments are unscheduled, making it challenging to calculate interest. You can also draw from your line of credit anytime, complicating interest calculations.

Additionally, many LOC lenders charge a monthly or annual maintenance fee. So you’ll still pay fees even if you do not use the line of credit. You can also expect other commitment fees whether or not you use your credit line.

So, before signing the agreement, ensure you understand your LOC’s interest rate and loan terms. Ensure you read the fine print and check for potential hidden fees.

One benefit of a line of credit is the flexible payment schedule. You only start paying interest when you draw from your credit line. On the other hand, you’ll need to pay interest on a bank loan as soon as it is issued.

Qualification Requirements: Business Line of Credit Wins

Business loans generally have stricter approval criteria. Some of the things banks and online lenders consider include:

- Bank statements

- Financial statements

- Business plan

- Incorporation documents and contracts

- Financial projections

- Collateral such as real estate, inventory, machinery, or accounts receivable

Business loans typically have stricter credit score requirements, too. Most lenders will require your business and personal credit reports. Some lenders may have looser credit standards, but in exchange you’ll most likely need to provide collateral and pay higher interest rates.

A line of credit is generally easier to qualify for. Lenders primarily look at your personal or business credit score, years in business, and annual revenue. You have a good chance of qualifying for a secured line of credit, even with an average or poor credit score, if you have enough income. Lenders may also overlook your credit score in favor of collateral. Though again, you may still see higher interest rates if you have poor credit.

Finally, a line of credit is a good option for boosting your credit score. Most new businesses do not qualify for traditional business loans. So a LOC can help you build a creditworthiness history that could make you eligible for a business loan in the future.

Funding Time: Business Line of Credit Wins

Generally, a line of credit has a faster funding time. This is because there are fewer requirements and qualification criteria to process. Most banks and credit unions take several days to approve loans. It can also take additional time before the funds are available after approval.

Additionally, many lenders prefer not to underwrite one-time small loans. This is primarily the case for unsecured loans. Therefore, a LOC can be a good alternative for accessing funds quickly.

However, this scenario isn’t always true. For example, some online lenders approve loans the same day or the next day. But, since LOCs are generally easier to qualify for, a line of credit is often the best option in an emergency or cash flow crunch.

Fixed vs. Variable Interest Rates: Business Loan Wins

Many business owners prefer a fixed interest rate. This type of interest is constant for the term of the loan. However, variable interest rates change depending on the market conditions.

Business loans typically let you choose between a fixed or variable interest rate. This flexibility is vital for people who prefer predictable overheads. A fixed interest rate also makes financial planning and analysis easier.

Fixed rates are also easier to understand. You do not have to perform complex calculations to determine how much you’re expected to pay monthly. This simplicity makes it easier to price shop and compare lenders.

Interest rates of LOC change depending on the prime rate. This structure means you pay a different interest rate every time you draw from your credit line. The fluctuation can make it difficult to project your expenses and plan your finances accurately.

Additionally, a variable interest rate doesn’t protect you from sudden fluctuations in the rate. This unpredictability is concerning during times of high inflation and market fluctuations. As a result, you may end up paying much more than you initially anticipated.

However, a fixed interest rate isn’t always the best choice. You’ll pay the same interest if the interest rate increases. Regardless, it’s desirable to have both options and choose the most suitable one for your borrowing needs.

Type of Credit: Business Line of Credit Wins

LOC has the advantage of having a revolving credit. You draw from the fund any time you wish. You get access to the maximum amount of credit available whenever you need it. Plus, you have continuous access to the funds as long as you make regular payments.

Business loans are only available once. After that, you’ll have to re-apply for another loan if you need more money. Therefore, you don’t get peace of mind that there are funds available when you need them.

Of course, you’ll pay for the convenience of revolving credit with higher interest rates. But, on the other hand, you also qualify for lower borrowing amounts. However, these drawbacks are worth it for business owners who require consistent cash flow.

Prepayment Penalty: Business Line of Credit Wins

Many lenders charge an extra fee for repaying your loan early. It’s known as a prepayment penalty. The penalty is more common with business loans. Lenders attempt to recover some of the lost interest by charging a prepayment penalty.

A line of credit features flexible payments. Therefore, you can pay as much as you wish without extra charge. Or, you might opt only to pay the interest on the borrowed amount in a given month.

This flexibility comes in handy during lean months or if you have cash flow fluctuations. You also don’t have to worry about incurring extra fees on a good month. In addition, you can opt to repay your loan faster so you can access the maximum credit amount during lean months.

There are ways to avoid a prepayment penalty on your business loan. For example, many lenders allow you to repay up to a certain percentage of your loan in one payment. Similarly, some lenders reduce or scrap the prepayment penalty once you’ve paid off a certain amount.

You can read your loan terms to find ways to avoid the prepayment penalty. This should also be an essential consideration when vetting lenders in the first place.

Final Verdict

Business loans are generally the better option for small business owners. These loans are structured, ensuring predictability when planning finances. Business loans also have longer terms and lower interest rates, which are ideal for financing expansion or significant business purchases.

However, there are instances when it makes more sense to open a line of credit. For example, a LOC is a better option if you need emergency funds or you need to address a cash-flow deficit. A line of credit is also a terrific alternative to spending your emergency fund.