California’s economy is one of the most powerful globally, and small businesses make up 99.8% of all companies in California.

LLCs represent 35% of small businesses in the US. This is because they offer some of the benefits of a corporation, like protecting personal assets without all the hassle and paperwork.

Starting an LLC in California can be a quick and straightforward process with a little help.

Your LLC can start generating profits faster than you thought was possible; just follow the steps below.

The Easy Parts of Starting an LLC in CA

Like most formal processes, starting an LLC sounds complicated, but it’s pretty straightforward. The process mainly consists of completing forms with basic information like your business name, address, and what your business does.

LLCs are the quickest path to success for most small businesses because of owner-friendly policies like pass-through taxation and liability protection.

Liability protection lets you protect personal assets like your home or car when you create your startup. Pass-through taxation enables members of your LLC to skip corporate taxes in favor of individual federal income taxes.

The articles of organization sound formal and complex, but this form is quick and easy to complete in California. Getting an EIN from the IRS is also an easy process. You can grab one online for free.

The Difficult Parts of Starting an LLC in California

It only takes a quick search to learn about the potential negatives of running a business in California. But when you look at creating an LLC, even the bad news isn’t so bad.

Naming an LLC in California can be tricky because of its list of requirements. But these rules have your customers in mind. They are a good guide to follow no matter what state you license your LLC, especially if you plan to operate nationally someday.

There are also some types of LLC, like the series LLC, that California doesn’t allow unless you’re a foreign entity. If you already have a clear business plan, confirm that the LLC structures in California will enable you to execute it as outlined.

Another downside to operating an LLC in California is the costly annual franchise taxes. These come in at a minimum of $800 per year, no matter how little your business earns.

The LLC operating agreement can also be tough to complete, but it’s common for any LLC. In a state known for lawsuits like California, this document can be a strong layer of protection for you and your business.

Local and state licenses can be more complex in California for the same reason. Maintaining an LLC in Cali means paying attention to regular changes in legislation. Headline-grabbing changes from the last several years include The California Revised Uniform Liability Act and The California Consumer Privacy Act.

These kinds of regulations can make ongoing compliance a headache for small business owners.

LLC services like ZenBusiness can help create your LLC and keep it compliant. This saves time and effort for you, so you can focus on growing your new business.

Step 1: Choose a Business Name

Choosing a name for your business sounds fun and easy, but it’s a very important decision. This step can be pretty time-consuming because California has rigorous naming guidelines. There are several places you’ll want to check for duplicates before you can choose your business name.

Brainstorm name ideas

As you think about your perfect business name, write out a long list of name ideas. If you jump on the first name you like, it may already be used by another company or website. You’ll want to avoid the hassle of negotiating for your chosen business name.

Add the LLC

Add one of these to your business name if it doesn’t already include it:

- Limited liability company

- LLC

- L.C.C.

- Limited

- LTD

- Company

- Co

You might wonder how the business name will impact your branding when naming your LLC. In this case, you can file a DBA (“doing business as”), which is like a nickname for your business. You’ll need to submit your DBA or fictitious business name in the county where you operate your business.

Cut confusion

An LLC name in California can’t include words that could lead customers to confuse your business with a state or federal agency. So, avoid names like The FBI: Fun Business Institute or The San Diego Treasury.

Some terms, like bank, university, or attorney, may require you to show that a licensed individual in that industry is part of your team.

You’ll also want to avoid words that indicate that your business offers insurance or terms that indicate your business is a corporation and not an LLC.

These regulations help make sure that businesses aren’t misleading the public.

As you choose a business name, ask friends or coworkers what comes to mind when they see your business name. This can help you make sure you are giving people the right idea about what your business does.

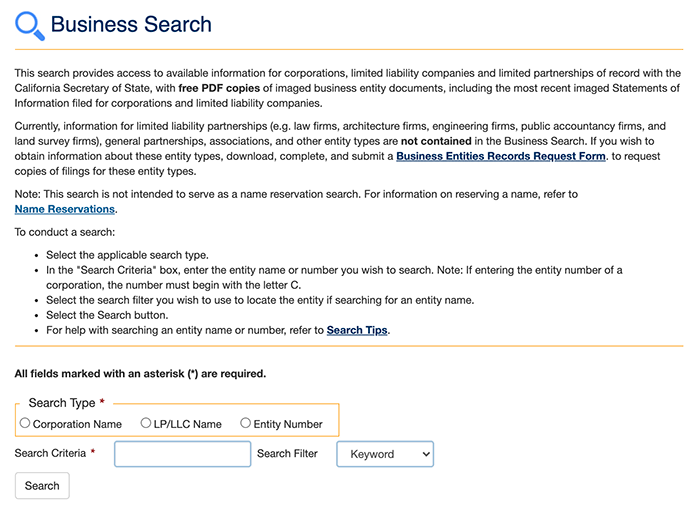

Look for state duplicates

Once you have a handful of good business names, do a business search for the State of California to see if your favorite names are available. If the name you choose is too similar to an existing business, you may have your LLC application rejected.

Search the web

Web domains are hot commodities. Check to see if the domain for your business name is available, even if you don’t plan to build a website right away.

Reserving and changing your name

If you’re still figuring things out but want to keep a business name just in case, you can reserve an available name for up to 60 days. Just file a name reservation request!

You also have the option to change your business name later.

Step 2: Sign Up for ZenBusiness LLC Formation Services

California has more one-of-a-kind rules and regulations than most other states. Their regulations also change more often than you might expect. Maintaining your LLC will mean careful attention to deadlines for annual reports, fees, and taxes. It’s also essential to follow their guidelines carefully when starting an LLC.

Business formation services like ZenBusiness take care of the tricky parts of registering your business as an LLC. They can also help you maintain your LLC status.

ZenBusiness pricing starts at $49 for the Starter plan, including preparing and filing the LLC paperwork, annual report service, an operating agreement template, and a 100% accuracy guarantee. The Pro plan is $199 and includes expedited filing, an EIN, compliance help, and more. The highest plan is Premium at $299. It has a “rush” filing speed and also includes a business website, domain name, email address, and more.

Agent of Service of Process

California requires businesses to have a registered agent, called an Agent of Service of Process.

This individual or business entity needs to be a full-time resident or corporation in California. They have to be available for company business during normal business hours every day the business is open during the year. The agent of service of process receives legal documents like tax forms and lawsuit notices.

They also maintain a calendar for compliance to make sure your California LLC is on top of required reports. Your agent also maintains an archive of legal documents. This makes it easy for your business to stay compliant when requirements change.

ZenBusiness offers registered agent service free for your first year as an LLC. The service is affordable and essential for any business with a small team and a tight budget.

They will take care of LLC compliance, so you don’t have to worry about annual filing and other deadlines. They also have expert support to guide your business through challenges that may come up.

Decide on management

The decision of whether your members or an outside manager will manage your LLC is an important one. The Beginner’s Guide to Members vs. Managers in an LLC can help you make this critical decision.

This is something you’ll need to decide before officially filing, as the answer is required on the articles of organization. You’ll choose between a member-managed or manager-managed LLC.

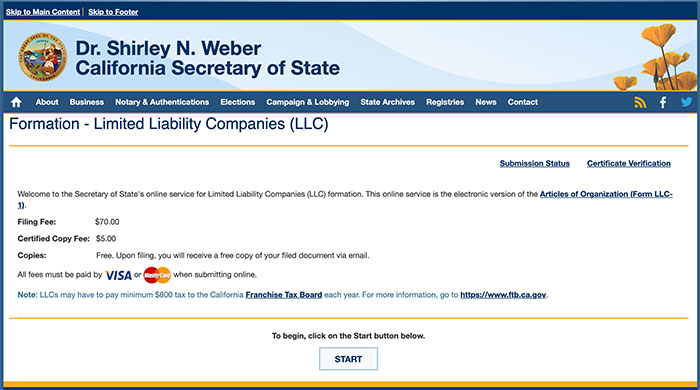

Step 3: File Your Articles of Organization

You’ll work with ZenBusiness to file your articles of organization.

Before you submit, be sure to proofread your forms carefully. Make sure you and your partners are on the same page about the details.

You can file online, in person, or by mail, and it costs $70. There is an extra $15 drop-off fee if you choose to submit forms in person.

The processing time after you submit the articles of organization is usually five days. For an additional $750, the state can process your filing the same day you submit it!

Each amendment to the original articles of organization costs $30. This process requires you to complete another form.

Step 4: Create Your LLC Operating Agreement

The operating agreement is a California LLC mandate. The operating agreement outlines the rules and expectations the LLC members have agreed your LLC will follow. Not all states require one, but even where it is not mandated, it is highly recommended.

This document is legally binding and will help protect your business from internal disputes when challenges come up.

You don’t have to file the operating agreement formally, but you’ll need to keep any written agreement or amendments with your LLC business records.

Use an operating agreement template

Your ZenBusiness plan comes with an operating agreement template. It can really simplify this complicated process.

Choices about profit and loss distribution, dividing ownership, and membership structure can be tough to agree on. Starting with this template can smooth the path to logical decisions.

Other things included in the operating agreement include voting rights, adding or removing an LLC member, and even dissolution procedures.

Most of us don’t want to think about the end when a project is only beginning. But outlining a plan for dissolving your LLC will help ensure all members have a clear picture of the future options for your new startup.

An operating agreement will also help ensure the courts maintain your California LLC status. This is just in case your team does something that puts your business in danger of dissolution, like forgetting to pay your filing fees or making changes to the business without amending your articles of organization.

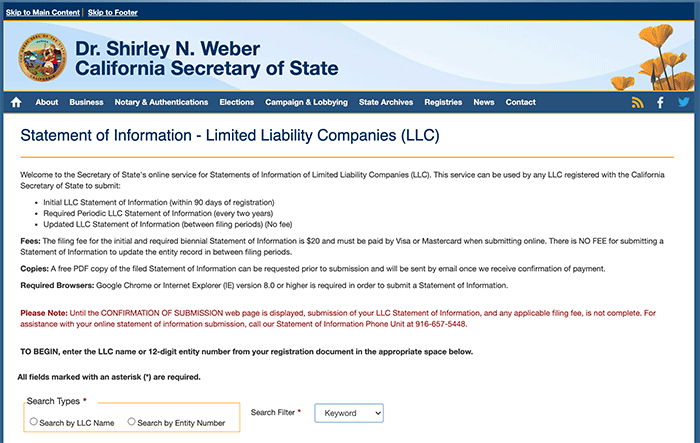

Step 5: File the Initial Statement of Information

You’ll also need to file the initial statement of information within 90 days of forming your California LLC. This costs an extra non-refundable fee of $20, and you can take care of this online, in-person, or by mail.

After the initial filing, you will need to file this statement every two years. This report will include basic information about your business. It has updated addresses and other contact information, along with confirming the main activities of your business.

If you stick with them, ZenBusiness will accept, scan, and archive legal mail for your business. That ensures that these critical communications are all in one place. This makes your LLC records easy to find, which makes it easier to maintain your LLC status.

Step 6: Compliance With California Tax, Federal Tax, and Other Regulatory Requirements

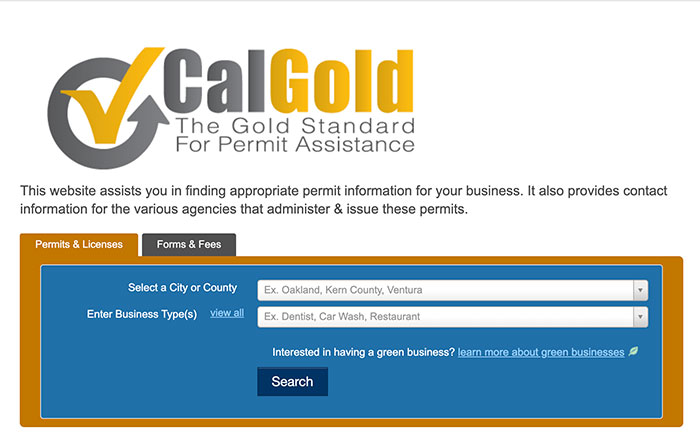

The location and function of your California LLC may mean that you’ll need extra business licenses for the compliant operation of your LLC.

For example, if you’re opening a clothing store LLC in Berkeley, California, you might also need:

- A business tax certificate from the city

- A DBA statement from Alameda County

- A CalGold certification for health and safety standards

If you operate in more than one California city, you may also need a license in each city where you operate. The CalGold website is a helpful place to get started.

You may also want to hire legal services to make sure you have everything covered. Incfile is the best online legal service for startups. They can help your team navigate the legal requirements in your local California community.

California sales tax and employee taxes

Your California LLC may also need to register with the California Tax Authority. California is a complex state for taxes. California employer taxes alone include:

- Employee withholding tax

- Employment training tax

- Unemployment insurance tax and disability insurance

Our Guide to Understanding How LLC Taxes Work walks you through the different types of taxes your LLC might encounter. It can give you an idea of how to prepare your business for those taxes.

California franchise taxes

Another to-do on the California LLC tax list is paying your annual franchise tax.

California’s fee is pricier than most other states. It’s an $800 annual fee regardless of your business income. LLCs making more than $250,000 also need to pay an extra fee.

Some LLCs may be exempt from this franchise tax. It’s a good idea to work with a tax professional to ensure that your business pays the minimum in taxes and state fees for compliance.

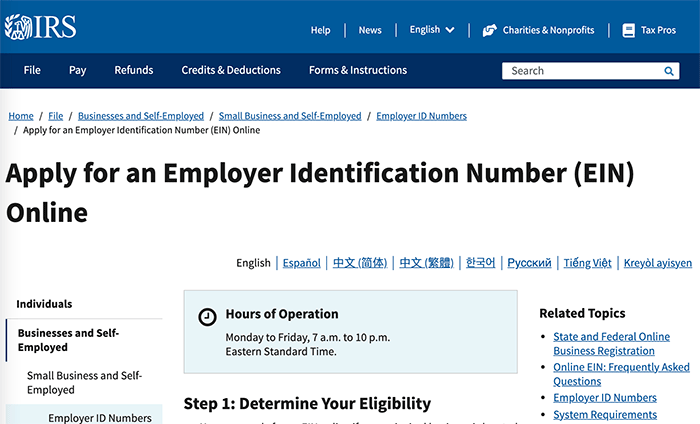

Step 7: Get Your EIN

An EIN is an employer identification number that the Internal Revenue Service assigns. You’ll need this ID number to file and manage your California state and federal taxes and to open a bank account for your LLC. The IRS offers a quick online form to request your EIN.

An EIN is also required if you plan to hire employees for your business. This ID is unique to your LLC, so you’ll need to request a new EIN even if you had one for your business before filing for the LLC.