Want to get started right now? Click here to sign up for ZenBusiness and start your LLC today.

Most new entrepreneurs exploring the market and setting up a business juggle various roles at a time and have limited time and budget. Therefore, it can be challenging for them to start an LLC.

Nowadays, several LLC service providers are available in the market. The Online LLC setup process provides cost-effective, fast, and reliable services to help you register an LLC without hassle.

These experienced service providers save you from the red tape and provide simple solutions to start an LLC in no time.

Let’s look at the various steps you need to follow to start an LLC in Indiana.

The 7 Best LLC Services For Starting an LLC in Indiana

You can avail the services of a reliable LLC service provider to easily create an LLC without any problem. To choose an LLC service, we recommend comparing each service’s pricing, plans, and benefits. We have shortlisted the seven best LLC services on the market today:

- ZenBusiness – Best overall

- Incfile – Best for entrepreneurs on a tight budget

- RocketLawyer – Best legal consultation services for LLCs

- LegalZoom – Most popular LLC services

- LegalNature – Best for LLC documents and contracts

- MyCompanyWorks – Best same-day processing

- Swyft Filings – Best customer service

Start an LLC in Indiana in 5 Easy Steps

Whether you create an LLC on your own or with the help of an LLC service, you are required to follow specific steps. Each state in the US has different laws and regulations for the creation of LLCs. Therefore, the specific steps can differ based on the state you reside in.

To start an LLC in Indiana, here’s what you need to do.

- Select a name for your Indiana LLC

- Provide an official business address for your Indiana LLC

- Take the services of a registered agent for your LLC in Indiana

- File your Indiana LLC articles of organization

- Create an operating agreement for your Indiana LLC

- Get an Indiana LLC employer identification number (EIN)

- Submit your biennial business reports to the Indiana Secretary of State

Step 1: Select a Name For Your Indiana LLC

The first step is selecting a name for your company. When choosing a name, it is crucial to carefully analyze and choose a name that follows the LLC naming guidelines of Indiana. You can easily search for the guidelines online.

Follow Indiana’s Naming Guidelines

Some of the rules that you must follow for naming an LLC in Indiana are:

- Whichever name you choose must be followed by or include the phrase “Limited Liability Company” or its abbreviation “LLC.”

- Any words in your company’s name that link it to or resemble a government agency’s name like the FBI can land you into legal problems.

- If you want to use a restricted word like bank or university, get a license first to avoid any legal complications.

- The name of your LLC must be unique and should not resemble the name of any Indiana LLC, limited partnership, corporation, or limited liability partnership.

You can easily use the LLC name availability checker to ensure that the name of your LLC isn’t already taken and is unique. You can also reserve a name by submitting a name reservation request to the Indiana Secretary of the State. Just apply online, however, if you do it by post, it can cost you around $10.

Ensure the Availability of the URL

It is crucial to ensure that the URL for your business name is also available before selecting the name of your LLC. Moreover, it is recommended to buy a URL for your company even if you don’t plan on creating a website. Ensuring availability and buying the URL prevents any future legal battles over your company’s name.

Using an Assumed Business Name

You are allowed to use an assumed name for your business for informal purposes. You can register the assumed name of your LLC with a county in Indiana, where your LLC operates.

After choosing a name for your LLC and securing a URL, your next step should be to select an LLC service provider to complete the process of registering an LLC. We recommend using ZenBusiness, which helps you get started within minutes.

Step 2: Provide an Official Business Address For Your Indiana LLC

In Indiana, every LLC needs to have an official street address. You can select the address of your home, office, or any other physical location as your official LLC address. The address is essential as it will go into public records and any relevant documents from the state will be received at the provided address.

If you find it challenging to secure a physical location for your LLC, you can use the address of a virtual mailbox. However, it must not be a PO box address. Another way to get an official address is by registering with an LLC service provider who will receive your mail for you and provide you with an address. Registering an LLC service’s address as your official LLC address can be beneficial for people who work from home and don’t want their private address to go public.

Step 3: Take the Services of a Registered Agent For Your LLC in Indiana

In the state of Indiana, it is mandatory to nominate a registered agent who will help you in the process of forming an LLC. Individuals and companies both can provide LLC creation services. The LLC agent or services that you choose should help you resolve any legal problems that your LLC may encounter. For example, if someone files a lawsuit against your LLC, your LLC agent or service should take responsibility and resolve the issue.

Moreover, the registered agent is also the point of contact for your business which means any tax forms, legal notices, or other official correspondence will be sent to them.

Your registered agent must fulfill the following criteria:

- The chosen agent should be a resident of Indiana

- The chosen agent should have an address in Indiana

If you are taking an agency’s services, ensure that the selected company is allowed to do business in Indiana.

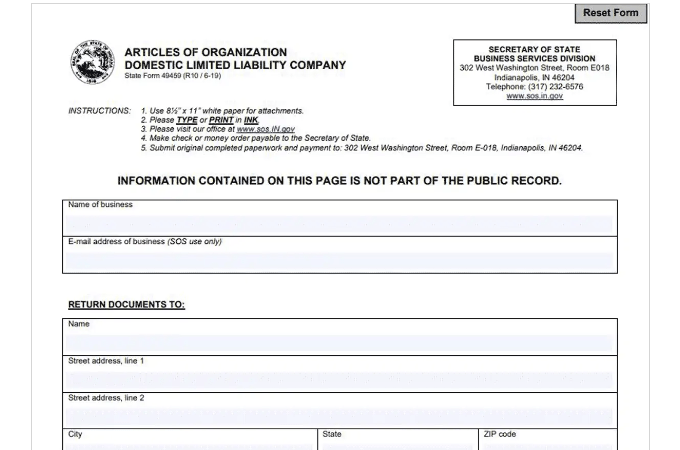

Step 4: File Your Indiana LLC Articles of Organization

The next step in the process of an LLC formation is to file articles of organization with the Indiana Secretary of State. You can file the article of organization with the Secretary of State Business Services Division. These articles must include:

- The name of the LLC

- The email address of the LLC

- The address and phone number of the main office of the LLC

- The name and address of the registered agent of the LLC

- The names and addresses of all the people signing the articles

- The signature of the organizer, a member, or representative

- The date of the articles from when they become effective

You can file these articles online or send them by mail.

Step 5: Create an Operating Agreement For Your Indiana LLC

An operating agreement is an essential document that helps you run your LLC without any problems. It helps clarify various company tasks like how profits and losses will be shared, which members will be authorized to conduct business, and more such decisions.

An operating agreement highlights the duties, obligations, rights, powers, and liabilities of all the members of an LLC. It is an internal document that helps to easily run your LLC.

In the absence of an operating agreement, the state laws will have more control over the fate of your company. In the case of a new LLC without an operating agreement, the articles of organization and limited liability company agreement automatically become the operating agreement of the company.

Other benefits that an operating agreement provides are:

- It helps resolve disputes among members

- It helps protect the company’s LLC status

- It helps to protect operational flexibility

- It aids in opening financial accounts

- It ensures that your business runs smoothly

A good operating agreement must specify whether your LLC would be managed by a member or a manager.

Member-Managed LLC

All the owners and members of an LLC collectively manage and operate the operations of a member-managed LLC.

Manager-Managed LLC

In manager-managed LLCs, a few chosen members manage the main operations of a business, whereas a few other members act as passive investors who don’t engage in the business operations.

Step 6: Get an Indiana LLC Employer Identification Number (EIN)

You have to comply with all tax and regulatory requirements that apply to your LLC. Some of the requirements include:

Employer Identification Number (EIN)

You can obtain an employer identification number from the internal revenue service. It is necessary to get an EIN even if you don’t hire any employees. Moreover, an EIN is also essential for a one-member LLC that is registered as a corporation to solve any tax-related issues.

Business Licenses

The location of your LLC or the type of business that you do may require you to obtain specific local and state business permits or licenses for your LLC. Information about state licenses can easily be found online. However, to get a local license, you need to check with the clerks of the city in which your LLC is located.

Department of Revenue

You may have to register your LLC with the Indiana Department of Revenue based on the type of business your LLC operates. For example, if you plan to hire employees, sell goods, and collect sales tax, you have to register with the Department of Revenue. The Department of Revenue has a straightforward online application process that helps you conveniently register and get started.

Step 7: Submit Your Biennial Business Reports To the Indiana Secretary of State

Once you have created an LLC in Indiana, it is essential to stay on top of Indiana’s filing deadlines to avoid unnecessary fines and maintain a good reputation.

All the LLCs in Indiana are expected to file biennial business reports with the Indiana Secretary of State. These reports should regularly be filed after every two years to update the information regarding your business.

The information can include:

- The name and address of your registered agent

- The address of your main office

- Name, email addresses, and official addresses of the members, managers, directors, and officers.

Moreover, an LLC report also specifies the activities of your business, details the finances, and highlights the growth strategy. Another reason to file a biennial report for your business is to maintain an active LLC status.

The primary purpose of the report is to keep your business records up to date with the State of Indiana. The government can use these records to track your LLC’s sales tax payments. Moreover, creditors and other parties can use this information to contact you.

You can file your report online or send it by mail. It is important to note that the failure to file your biennial report can result in the dissolution of your LLC. You can take the services of a registered agent to maintain privacy, avoid late filing penalties, and gain more flexibility.

Final Thoughts About Starting an LLC in Indiana

Starting an LLC can seem like a daunting experience. However, if you carefully read the rules and regulations and correctly follow the steps, it is a simple process. Many businessmen may not have enough time to handle all the aspects involved in establishing an LLC. Therefore, it is always easier to take the services of an LLC service to avoid any mistakes and quickly create an LLC in any US state.

There are seven steps involved in the creation of an LLC in Indiana. First, you must select a name and physical address for your LLC. Contact a registered agent and file your articles of organization. Afterward, create an operating agreement and get your EIN. Ensure that you follow all the deadlines and regularly submit a biennial report to maintain the active status of your LLC.