When seeking to start an LLC in South Carolina, ZenBusiness is the best option for most, as it has a low price and is very easy to use. You only need a few minutes to create a South Carolina LLC with ZenBusiness.

Creating an LLC (limited liability corporation) is a key first step for many people who are starting a business. However, because each state has its own rules and regulations for the formation of LLCs, it’s important to make use of the right forms for your location.

Starting an LLC in South Carolina is easier when you make use of an LLC service. These services walk you through the process of completing the forms and understanding the fees for setting up an LLC in the Palmetto State or in any other specific state.

The 7 Best LLC Services for Starting an LLC in South Carolina

When you are ready to set up your LLC in South Carolina, making use of one of the seven best LLC services is a smart choice. These services simplify the process and ensure that you don’t miss any steps.

- ZenBusiness – Best overall

- Incfile – Best for entrepreneurs on a tight budget

- Rocket Lawyer – Best legal consultation services for LLCs

- LegalZoom – Most popular LLC services

- LegalNature – Best for LLC documents and contracts

- MyCompanyWorks – Best same-day processing

- Swyft Filings – Best customer service

Start an LLC in South Carolina in 8 Easy Steps

When starting your LLC, you could go to your local government’s website, download all the forms, and fill them out yourself. But it could be challenging to avoid missing any steps when doing it yourself, so you may want to use an LLC service that guides you step by step.

- Enter Your Company Name

- Follow the Prompts

- Select a Registered Agent

- File the Articles of Organization in South Carolina

- Complete Your Order

- Obtain an EIN

- Obtain Other Documents

- Stay in Compliance With South Carolina Laws

As we walk you through the steps to start a South Carolina LLC, we are going to use ZenBusiness as our guide. Using an LLC service makes the process go so fast and so accurately that it’s often worth a little bit of extra cost. ZenBusiness simply makes creating an LLC in South Carolina as easy and quick as possible.

Step 1: Enter Your Company Name

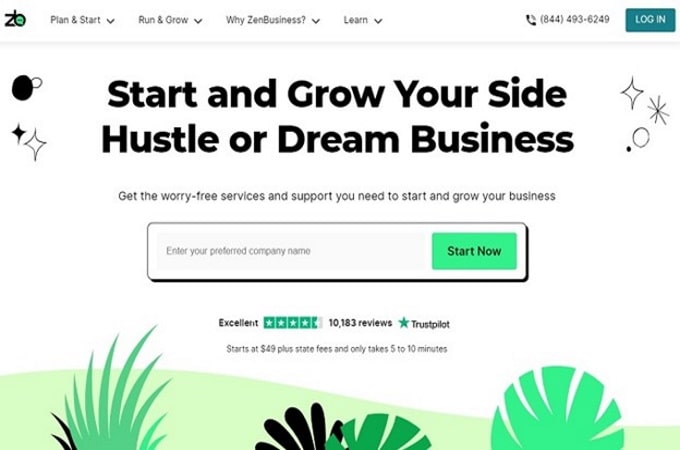

You do not need to sign up for ZenBusiness or submit a credit card to try out the service. You will make your payment a few steps later if you choose to create your LLC through ZenBusiness.

On the ZenBusiness home page, click on the text box in the middle of the page. Enter the name of the business and click the Start Now button. You will have the opportunity to change or edit the company name later in the process.

As long as no other business in the state of South Carolina has the name you want or a very close variation of the name you want, you should be able to use it.

When naming your South Carolina LLC, you may want to come up with the most descriptive name possible. It should also be distinctive, especially compared to companies that may be competing with you.

To create an LLC, the business name will need to have the letters LLC or the words Limited Liability Corporation in the name somewhere. Most people simply tack LLC onto the end of the business name.

When you enter your business name on the ZenBusiness home page, ZenBusiness will let you know if the name you want is available. You also can search on the South Carolina Secretary of State’s website to see if your desired name is available. If it is unavailable, you would need to pick a different name.

Before picking a name, you may want to make sure the name is available as a domain name for a website too. You don’t want to have to create a website with a different name from your preferred business name.

Step 2: Follow the Prompts

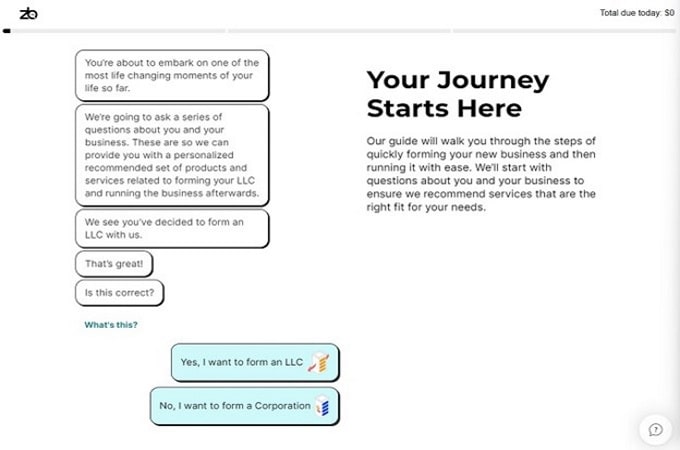

After you enter your desired LLC name, ZenBusiness will respond by asking you a series of questions. Just click on or enter the answer that best fits your plans for starting your LLC. Again, you will have the opportunity to make edits to your choices later in the process. However, the more information you provide with accuracy now, the faster the process will go.

In the upper right corner of the windows with the prompt questions, you’ll see a running tabulation of any fees that you will owe. As you form an LLC in South Carolina, you are going to have fees that must go to the state to register your LLC. If you choose to use ZenBusiness, you also will have some fees related to using this LLC service. The software tracks these fees in the upper right corner.

You’ll also see a bar across the top of the page that shows your progress through this section of ZenBusiness.

Step 3: Select a Registered Agent

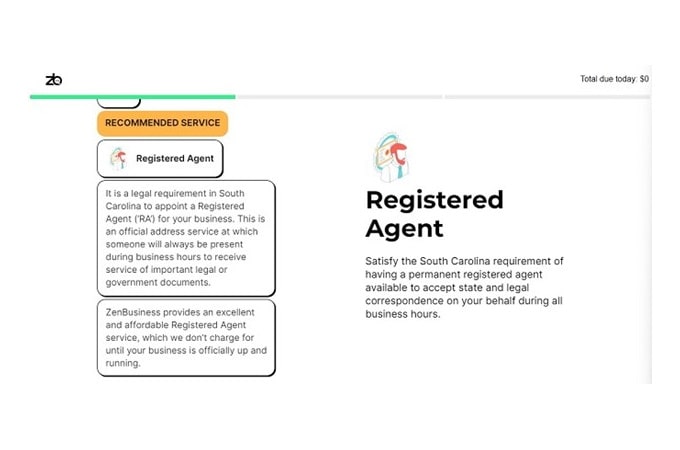

Laws in South Carolina require that all LLCs formed in the state have an appointed registered agent. South Carolina regulations sometimes call this person the Agent for Service of Process.

A registered agent is a person who officially accepts and maintains correspondence for your business. When the state needs to make contact with your business, it will reach out to your registered agent of record. Consequently, your registered agent needs to be available during normal business hours. (Contact from the state of South Carolina is not common, but it does occasionally happen.)

Should the registered agent be unavailable or if the state cannot make contact with the agent, this could cause problems for your business. You could end up receiving a court order, or you could receive a default judgment. If your registered agent is not available to receive notification of the court order, you could end up with even deeper problems.

The registered agent will need to sign official documents that are part of the LLC and that go on file with the state. Additionally, the registered agent’s contact information will be available through the state for others who request it.

You can choose to serve as your own registered agent for the LLC, or you can hire someone to be the registered agent. In fact, when you are creating your LLC through ZenBusiness, you can hire ZenBusiness to serve as your registered agent for $199 annually. You then know someone will always be available to respond to queries from the state.

If you hire a third party like ZenBusiness to serve as your registered agent, that party should track all your correspondence from the state. The third party then will make sure you always have access to these documents.

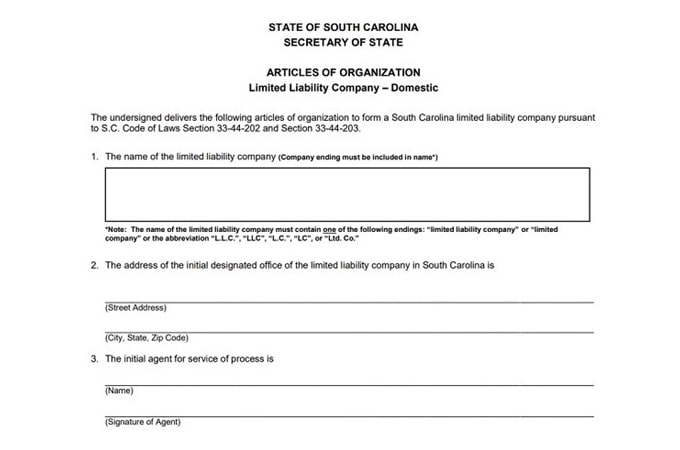

Step 4: File the Articles of Organization in South Carolina

To officially start your business, you will need to file the South Carolina Articles of Organization. This is the step that makes everything official, so this is exciting and maybe a little nerve-wracking at the same time.

You will file the Articles of Organization with the Secretary of State. You can file these documents on paper and by mail after a download from the Secretary of State’s website, electronically through the Secretary of State’s website, or through ZenBusiness or another LLC service.

When you choose to file through ZenBusiness, you will pay a little extra versus filing through the state’s website. Filing through the state’s website costs $110, but ZenBusiness charges $125.

To file your Articles of Organization through ZenBusiness, you may need to agree to an annual service plan that provides you with advice and other services for operating your business, such as seeking a domain name and setting up a business email address.

Additionally, with the annual subscription, ZenBusiness will make certain you stay up to date with all filings and reports that South Carolina requires annually or every few years. This will keep your business in good standing years down the road. ZenBusiness’ annual service subscriptions cost $199 to $299 per year, although new customers potentially can pay $49 in the first year. (The $125 filing fee is on top of this service subscription fee.)

South Carolina does not offer expedited filing of your Articles of Organization. However, if you choose to file electronically, the state’s processing actions will only take a day or two. If you file by mail on paper, expect the processing actions to take a few weeks.

If you are not quite ready to file your Articles of Organization, you can file an application with the state that allows you to reserve your preferred name. This costs $25. ZenBusiness does not have an option for filing the document to reserve your name. You should only use ZenBusiness when you are ready to complete all of the paperwork.

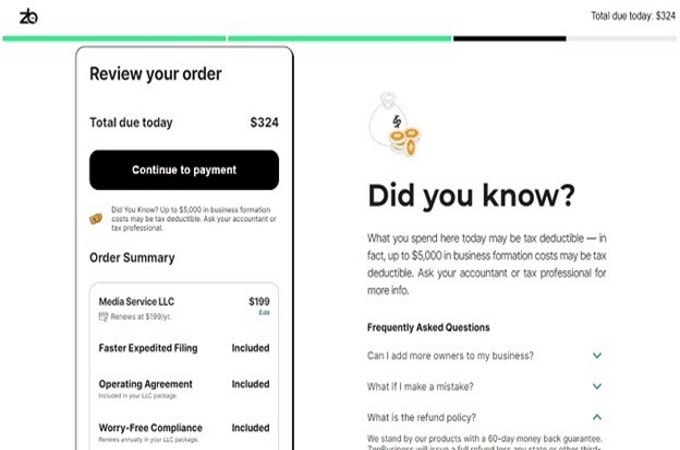

Step 5: Complete Your Order

If you decided to file electronically through the Secretary of State’s website, you would pay your fees at the time of checkout.

If you choose to file by mail, you will need to send payment along with the paper document. You also need to include a self-addressed, stamped envelope with your payment to receive an official copy of the filed documents.

If you choose to make use of an LLC service like ZenBusiness to guide you through the process of setting up an LLC in South Carolina, you will need to pay for the services you selected. Depending on how many extra services you selected, you could pay anywhere from about $175 to $1,000 or more. (Some of these expenses may be tax deductible for your new business.)

Some of these costs are one-time fees with ZenBusiness and some of them are annual costs. If you agree to some annual plans or recurring monthly plans, ZenBusiness will automatically charge your credit card at the date of renewal. You would need to contact the ZenBusiness customer service team to cancel these automated payments before the date of renewal.

Before you give ZenBusiness your credit card information, you can review all the purchases you selected, just in case you want to add or remove some features.

ZenBusiness does offer a 60-day money-back guarantee, which is a nice feature.

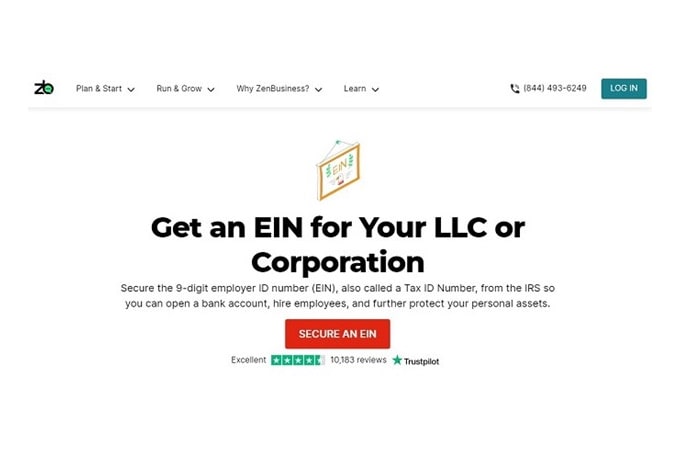

Step 6: Obtain an EIN

After you complete the process of registering your LLC in South Carolina, you then can obtain an EIN, or Employee Identification Number. The Internal Revenue Service issues all EINs, but you will need to have one to pay your taxes to the state and federally.

The EIN for a business most closely approximates what an individual person’s SSN, or Social Security Number does. It works for identification purposes with the government, as well as for tracking income and taxes.

You may even need to have an EIN in place before you can open a bank account for your business or apply for loans. If you ever plan to hire employees, you will need an EIN.

You can visit the IRS website to apply for your EIN. When you subscribe to ZenBusiness, this service will help you obtain the EIN as well.

Step 7: Obtain Other Documents

Depending on the nature of your new business, you may need to obtain a few extra documents to be able to operate in South Carolina. The required documents differ from state to state, so be certain you are paying attention to the documents required in South Carolina.

- Certificate of Compliance: If you need to show that your business is up to date on tax returns and tax payments, this certificate from the South Carolina Department of Revenue is available starting at a cost of $60.

- Certificate of Existence: South Carolina does not require businesses to hold a Certificate of Existence, but you may need this document to open a business bank account. The Secretary of State issues this document, starting at a cost of $10.

- Doing Business As: If your business will be operating under a name that is different from your LLC name, you will need to protect this Doing Business As (DBA) name. South Carolina does not require you to register your DBA name. However, the state does require that your DBA name does not infringe on any other business name in the state. You can apply for a trademark for your preferred DBA name, starting at a cost of $10.

- Sales Tax License: If your business will be selling products, you need to hold a state tax license from the South Carolina Department of Revenue. The cost for this license starts at $50.

- Business Licenses: Depending on the type of business you are operating in South Carolina, you may need to obtain and hold current business licenses.

ZenBusiness gives you access to these documents through its EIN & Business Documents service, which costs $149. ZenBusiness will even help you file or obtain some of these documents, if desired. You also can download and complete these documents through the South Carolina Secretary of State’s website, too.

Step 8: Stay in Compliance With South Carolina Laws

As your business grows and continues to operate in future years, you will need to follow all laws in the state of South Carolina for operating your LLC.

South Carolina does not require LLCs to file annual reports unless you choose to have the state tax your LLC at a corporate rate. You may need to file amended documents, such as Amended Articles of Organization, to reflect any changes to your LLC. If you have an unusual type of business, you may need to file other documents annually.

ZenBusiness allows you to sign up for a service that helps you keep track of any documents you must file in the future for $199 per year.

Final Thoughts About How to Start an LLC in South Carolina

Making the decision to start a new business takes a lot of creative thought and planning. However, it also requires filling out a lot of paperwork and forms. You don’t want to risk a mistake with these forms, or you could set your business back weeks or months.

An LLC is one of the best structures to use for a small business. Creating an LLC in South Carolina, and properly filling out the paperwork, becomes far easier when using an LLC service. These services walk you through the proper steps and help you catch any potential mistakes before the filing process takes place.