Securing external funding is part and parcel of operating a small business. The two main options are secured or unsecured small business loans. While unsecured loans have advantages, secured loans are the better option for most people.

Secured loans are more accessible, offer higher borrowing limits with lower interest rates, and can be paid back over an extended period. This post covers everything you need to know about secured vs. unsecured business loans to help you make an informed decision.

Secured Small Business Loans Pros and Cons

Pros

- Lenient credit score requirements

- Larger borrowing amounts

- Lower interest rates

- Longer repayment periods

- Easier to access

- Possible tax benefits

Cons

- Slower to fund

- Risk of losing business assets

- Requires collateral

Unsecured Small Business Loans Pros and Cons

Pros

- No physical collateral required

- Quicker to fund

- Simpler application process

- Builds credit history

Cons

- More difficult to access

- Higher interest rates

- Smaller borrowing amounts

- Shorter repayment period

- Potential personal guarantee or UCC lien requirements

The 11 Best Business Loans for 2022

The Quick Sprout team has done a lot of research into where to get the best business loans right now. The top 11 are below and you can read our in-depth reviews on each to see which might be the best fit for your business needs.

- Bluevine — Best for established businesses seeking lines of credit up to $250,000.

- Lendio — Best small business loan marketplace with 75+ lenders.

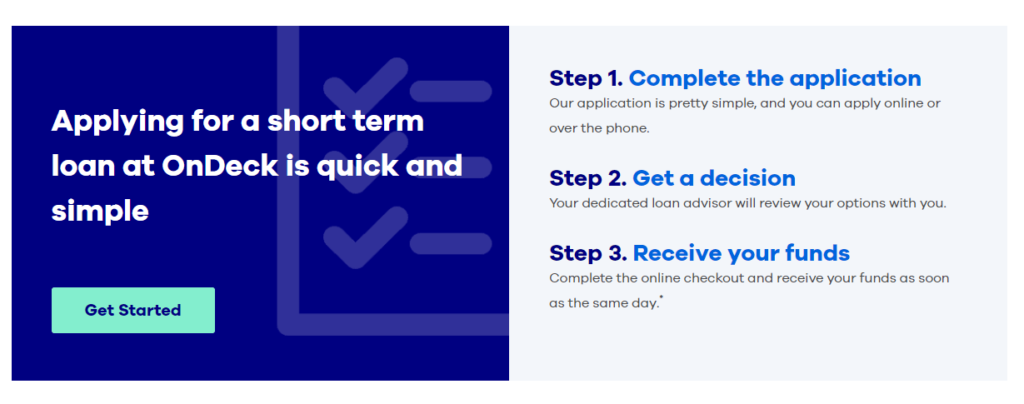

- OnDeck — Term loans and lines of credit for business owners with a 600+ FICO score.

- Fundbox — Best for new businesses in need of inventory or supplies from vendors.

- Funding Circle — Best small business lender for loan terms up to five years.

- Kabbage — Best for businesses with low monthly or annual revenue.

- Lending Club — Best P2P lending marketplace for business loans.

- Kiva — Microloans up to $10,000 at 0% interest for entrepreneurs.

- SmartBiz — Best for SBA loans up to $5 million with 25 year terms.

- Credibility Capital — Bank-backed loans for business owners with great credit.

- CAN Capital — Best merchant cash advance for small business.

Loan Type: Tie

As the name suggests, a secured business loan requires the borrower to provide collateral to secure funding. The lender uses the collateral to offset the risk if the borrower defaults on the loan. The lender may seize the collateral to satisfy the debt and interest if you default on your payments.

There are many types of secured small business loans, including:

Traditional Term Loans – This is the most common secured small business loan type. The terms are straightforward. You receive a lump sum from the lender. Then, you repay a portion of the principal and interest every month.

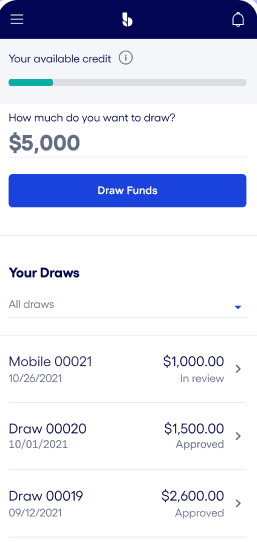

Business Line of Credit (LOC) – This type of secured loan is also called revolving credit. It works like a credit card. The lender gives you access to a specific amount of money, known as a credit line. You can draw from your credit line as needed. Your credit line is replenished as you repay the debt.

SBA Loan – This type of loan works like a traditional term loan. However, the Small Business Administration (SBA) guarantees part of the loan, so you’re not liable to pay the total amount. For example, Standard 7(a) allows you to borrow up to $5 million. In addition, the SBA may guarantee 85% of the loan to $150,000 and 75% if you borrow more than $150,000.

Self-Securing Business Loan – This type of loan doesn’t require additional collateral. Instead, you can use your purchase as collateral. For example, you can put up a tractor that you want to purchase as collateral for the loan used to buy it. It’s a great option if you don’t want to compromise your personal or business assets.

On the other hand, unsecured loans don’t require you to put up collateral as security. Instead, the lender trusts that you will honor your commitment. However, some lenders may need a personal guarantee that you’ll repay the loan.

Similarly, there are several types of unsecured business loans, including:

Working Capital Loans – This short-term loan covers your day-to-day business expenses. For example, you can use the working capital loan to meet payroll or keep the machinery running.

Unsecured Term Loans – This loan type works like a traditional term loan. The only difference is the lender doesn’t require collateral to process your loan request.

Revolving Credit – This loan provides you with a line of credit (LOC) to draw from at any time. Again, the lender doesn’t require collateral to advance a LOC.

Overdraft – A lender provides a loan or credit limit up to a certain amount. You can use these funds in pre-agreed installments. The lender charges interest on the borrowed amount.

Other unsecured business loans include business credit cards, merchant cash advances, microloans, and government-backed unsecured loans. Secured and unsecured loans are equally diverse and tailored to your funding requirements.

Lender Type: Secured Loan Wins

Many lenders offer secured and unsecured loans. For example, most banks, credit unions, and financial institutions service secured and unsecured loans. You can go through the requirements for each loan type and decide the one you are most likely to qualify for.

Other potential lenders include online lenders, crowdfunding, and peer-to-peer lender. However, unsecured loans are inherently riskier for the lender. Therefore, most lenders require security such as collateral or a personal guarantee.

Although unsecured loans are widely available, you’ll have an easier time qualifying for a secured loan. In addition, people with a poor or non-existent credit history have a tough time accessing unsecured loans.

Funding Amounts: Secured Loan Wins

The amount of money you need to borrow is critical when choosing between secured and unsecured loans. Generally, secured loans offer more funding than their unsecured counterparts. This is especially true if you provide valuable collateral, such as real estate, inventory, or equipment.

On the other hand, unsecured loans are primarily used for short-term expenses like paying seasonal employees or purchasing inventory. Depending on the lender, most unsecured business loans range between $1,000 and $100,000. Conversely, secured loans are available for up to $50,000,000.

Interest Rates and Loan Terms: Secured Loan Wins

Unsecured loans typically attract higher interest rates due to the inherent risk the lender takes on. Depending on the lender, you can expect interest rates between 7% and 30%. Unsecured loans are also short-term. Most lenders provide a loan term of 3-18 months.

Secured loans offer lower interest rates, especially if backed with valuable collateral. The interest rates vary between 2.5% and 13%, depending on the lender. You can also expect a more extended repayment period, usually between five and 30 years.

A secured loan is more likely to offer favorable interest rates and terms than an unsecured loan. Therefore, it is critical to be realistic about how quickly you can afford to repay unsecured loans. Some lenders also require some guarantee that you’ll honor the loan terms.

For example, an unsecured loan may take a percentage of your credit card transactions or a personal guarantee. A secured loan may be a good alternative in this case since you’re putting up security either way. In addition, you’ll benefit from a lower interest rate and an extended repayment period if you opt for the secured loan.

Qualification Requirements: Secured Loan Wins

Secured and unsecured loans have different qualification requirements. These requirements reflect the risk involved with each type of loan. The typical considerations for a secured loan include:

- The value of the collateral

- Business plan

- Cashflow history and projections

- Credit history

- Tax returns

A secured loan lender may consider other financials, including personal and business assets. As a result, secured loans have more stringent qualification criteria. There’s also more paperwork involved. In most cases, secured loan lenders consider collateral the most critical factor when assessing loan applications. Therefore, secured loans typically have more lenient credit score requirements and terms.

Unsecured loan requirements zero in on your creditworthiness. The typical qualification requirements include:

- Loan amount and purpose

- Annual turnover

- Time in business

- Credit history

Unsecured loans have fewer qualification requirements. You only need to prove that you can repay the loan. Otherwise, you may not need to file additional paperwork such as tax returns or a business plan. However, unsecured loans prioritize credit score, annual turnover, and time in business.

While secured loans have more qualification requirements, these requirements are less stringent. For example, a new business with a short credit history and low annual turnover may still qualify for a secured loan based on the strength of the business plan and collateral. However, such a business is less likely to qualify for an unsecured loan.

Funding Time: Unsecured Loan Wins

Secured loans have long application processes. The review and approval processes may be equally lengthy. It typically takes three to four weeks to receive funds. For instance, it may take time for the lender to assess the value of your collateral. Therefore, a secured loan might not be the first choice if you need funds immediately.

On the other hand, most of the information unsecured loan lenders require to assess your creditworthiness is available in your credit report. There are also fewer documents to process. As a result, you may receive funds in as little as 24 hours after successful application.

There are lenders who process secure loans quickly. However, a secured loan isn’t an option in an emergency in most cases.

Tax Benefits: Secured Loan Wins

You may be eligible for tax benefits if you take a secured business loan. For example, you may be able to write off the interest on the loan on your tax return. This is especially true if you use personal assets such as your home as collateral.

Unsecured business loans typically do not offer tax benefits. This downside may be enough to opt for a secured loan. However, there are conditions for qualifying for a tax break. For instance, you can only write off the interest if you use the funds for business-related expenses.

Fixed vs. Variable Rate: Secured Loan Wins

It’s equally important to consider whether a fixed or variable interest rate is more attractive. A fixed interest rate remains constant for the life of the loan. On the other hand, a variable interest rate fluctuates depending on the market.

Each option has its benefits. For example, a fixed interest rate is more predictable. You know exactly how much interest you must pay every month. This predictability is crucial for forecasting your finances accurately.

However, variable loans typically charge lower introductory rates. Variable interest rates are also typically lower than fixed rates. You’ll also pay lower interest if the overnight market rate goes down.

Either way, it’s ideal if you have the option of either fixed or variable interest rates. Most secured loans offer this option. However, most unsecured loans only offer fixed interest.

Some lenders may offer variable interest for unsecured loans. However, the repayment period is too short for the variable rate to offer tangible benefits.

Asset Takeover: Secured Loan Wins

The term unsecured may be misleading. You are still obligated to repay an unsecured loan, including the agreed-upon interest. The lender has recourse in case you default. It doesn’t matter if you didn’t provide collateral.

For example, the lender may sue you for your personal assets or wages if you default on your payments. The consequences may include losing personal property such as your home or car. The court may also impose wage garnishments until you repay the outstanding loan.

The asset take-over terms of a secured loan are straightforward. You know precisely what is at stake from the beginning. Defaulting on unsecured loans puts your business and personal assets at risk with no prior warning or consideration.

Besides, most lenders are willing to restructure or renegotiate loan terms if you cannot pay. So, providing collateral doesn’t always mean that you will lose your assets in case of unforeseen financial difficulties.

Prepayment Penalties: Secured Loan Wins

Some lenders charge a fee for paying off your loan early. This fee is called a prepayment penalty. Lenders use this penalty to recoup some of the lost interest lost when you pay before the loan term ends.

Many secured and unsecured lenders prefer not to charge a penalty for repaying your loan before it is due. However, many unsecured loans charge a prepayment penalty. This is because of the high interest the lender loses when you pay early.

Read the loan terms to ensure that there’s some wiggle room. For example, many secured loans allow you to repay extra up to a certain amount in one payment. The prepayment penalty may also decrease as you repay your loan.

Unsecured loans are short-term in nature. So the lender might be less willing to waive extra fees. Short-term lenders have a smaller window of earning interest.

Final Verdict

There are many reasons why secured small business loans are the better option for most people. These loans are more accessible to businesses with a poor credit history. Additionally, you can qualify for higher borrowing amounts that you repay over longer periods.

However, a secured loan isn’t always the best option. For example, an unsecured loan is a good choice if you need access to funds quickly. Regardless, weigh the pros and cons of each loan option carefully before making your final decision.